DAVID ADAMS reports…

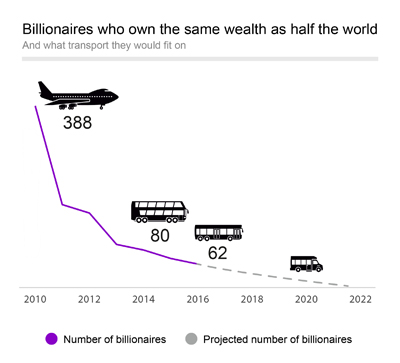

Just 62 billionaires now own as much wealth as the 3.6 billion poorest people in the world, according to data released this week by humanitarian aid agency Oxfam.

In a new report released ahead of this week’s World Economic Forum gathering in Davos, Switzerland, Oxfam says that while the wealth of the richest 62 people has risen by 44 per cent or more than half a trillion US dollars in the five years since 2010, the wealth of the poorest 3.6 billion people has declined by just over a trillion.

|

|

|

GRAPHICS: Oxfam Australia |

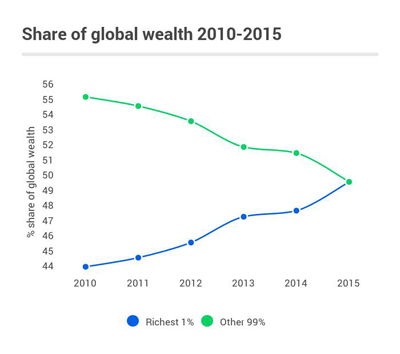

Oxfam last year predicted that the richest one per cent would own more than the poorest 50 per cent in 2016 if then current trends had continued, but Dr Helen Szoke, CEO of Oxfam Australia, said the organisation had been shocked to see this come true in the past year.

“(I)t’s that classic case of the rich get richer and the poor get poorer…” she says. “Really, it gives some sense of urgency to why we’re calling for global tax reform.”

The report, An Economy for the 1%, shows that since the turn of the century, the poorest 50 per cent of the world’s population have received just one per cent of the total increase in global wealth while half of that increase has gone to the wealthiest one per cent of people.

It pays tribute to the “fantastic progress” in halving the number of people living in extreme poverty between 1990 and 2010, but notes that had inequality not grown over that period, an estimated 200 million extra people would have escaped poverty – a figure which could have risen to 700 million had poor people benefitted more than the rich from the economic growth the world has seen.

Australia has not been exempt from the inequality. Data shows that since 2000, the richest 10 per cent of Australians have enjoyed 50 per cent of the total increase in national wealth while the poorest 10 per cent’s share of this increased wealth has been “almost zero”.

Speaking to Sight this week, Dr Szoke says the WEF, like the meetings of the G8 or G20, was a “key global moment” for action to be taken on issues like wealth inequality. She says Oxfam is calling for both businesses and governments to “be bold” in tackling the issue of inequality through increased transparency and legislation to ensure everyone is paying their fair share of tax and that this money is being most effectively used to lift people out of poverty.

Dr Szoke says while some progress has been made in tackling the issue by both businesses and governments, “the sheer volume of loss of potential” through practices such as corporate tax-dodging – estimated by the UN to cost developing countries about $US100 billion a year – meant further action was needed.

“It’s question of (corporations) paying their fair share of tax and continuing the momentum to actually lift people out of poverty which we can’t do unless we get some of these global reforms…I don’t think we can be complacent and rest on our laurels in terms of the successes of the past. Just as we need to refresh our…view of the world, we need to refresh how we tackle poverty.”

Dr Szoke says that if the gap between the world’s richest and poorest people is allowed to continue to grow, one of the ramifications is that power will be further concentrated in the hands of a few. “We can see the influence that big corporations or very wealthy people have on political judgment or political decision-making.”

While Oxfam is calling for numerous reforms in its latest report – from paying workers a living wage to promoting women’s economic equality and keeping the influence of powerful elites in check, Dr Szoke says the “quick fix” is starting the process to abolish tax havens which Oxfam says contain an estimated $7.6 trillion.

“But it is a case of another brick in the wall. We’re not saying that is the solution in and of itself and we shouldn’t lose sight of these other very important things – there’s no point in making sure than countries declare what tax they pay in Sierra Leone if the (country’s) government doesn’t also make a commitment to build solid public health infrastructure so we don’t ever have (another) experience of the Ebola kind of plague…But let’s start somewhere and let’s start with the fact that there is big money tied up in these tax havens which suggests that money has not been diverted into appropriate taxation (or) the fair share payment of tax.”

~ www.oxfam.org.au/wp-content/uploads/2016/01/an-economy-for-the-1-percent.pdf