Australian mining companies funnelled an estimated $A1.1 billion out of Africa through the use of tax havens in 2015 – a figure which equates to almost $A289 million in lost tax revenue, according to a new report.

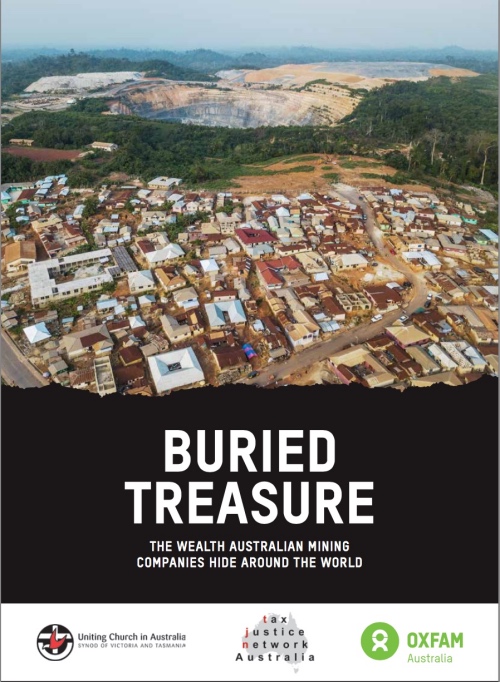

Cover of the joint report

The joint report from Oxfam Australia, the Tax Justice Network Australia and the Uniting Church in Australia – Buried Treasure – says the lost tax revenue “could have been used for schools, hospitals and other vital services”.

By way of example, it says the figure of $A289 million is “almost seven times the total cost of national malaria control programs in nine of the sub-Saharan African countries – among the poorest countries in the world – where Australian mines operate”.

The report claims Australia – which is described as having one of the largest global mining footprints” – is a “laggard” when comes to global mandatory tax transparency.

“Our research showed that it is rare for Australian mining companies to reveal enough tax data for the public to easily understand their full global tax practices,” the report says. “Those that do reveal global tax data have mostly made this move in the context of laws changing in countries other than Australia.”

The report calls for Australia to introduce a “strong system of public tax transparency” and for Australian mining companies to publish much more information about the tax they pay around the globe.

The report also contains a ranking of 40 ASX-listed companies according to which are the most and least transparent in the public reporting of their tax affairs.

Mark Zirnsak, spokesman for the Tax Justice Network Australia, said the estimated tax avoidance by the Australian mining sector in Africa was just “a snapshot of an enormous global problem”.

“This is simply not good enough – it is time for Australian companies to lead the way on transparency and the government to act to bring an end to this scourge.”

Speaking to the ABC in the wake of the report’s release Minister for Housing and Assistant Treasurer Michael Sukkar said Australia was a global leader in the international fight against corporate tax avoidance and a “strong advocate of tax transparency”.

The ABC also spoke with three mining companies named in the report which described its claims as false and misleading.

Correction: The headline was corrected from countries to companies.